- Home

- Sustainability

- Corporate Governance

Founded in 1837, in Salvador/BA, Wilson Sons is a Brazilian company and, since 2007 is listed on the B3 S.A. - Brazil, Bolsa, Balcão (B3), the Brazilian Stock Exchange. In 2021, we became part of the Novo Mercado Segments using the ticket PORT3, the B3 listed segment in which are the companies with the best governance practice. Also we benefited from the experience of our controller, the Ocean Wilsons Group, listed on the London Stock Exchange for over half a century via Ocean Wilsons Holdings Ltd.

- Shares listed on the New Market of the B3 (segment in which are the companies with the best governance practice);

- Seven members on the Executive Board;

- Two independent Board members;

- A 100% tag-along right for all minority shareholders;

- One class of shares, with equal voting rights;

- Financial results published every quarter in IFRS standard;

- Separate positions for Board Chairman and CEO;

- At least four meetings during a given year of the Executive Board;

- Executive Board approval for all projects valued over R$ 25 million;

- Publishing of the Executive Board meeting minutes;

- Auditing Statutory Committee;

- Corporate governance guidelines duly approved by the Executive Board;

- Professional standards for business conduct;

- Code of ethical conduct;

- Anti-corruption guide;

- Disclosure and negotiation policies.

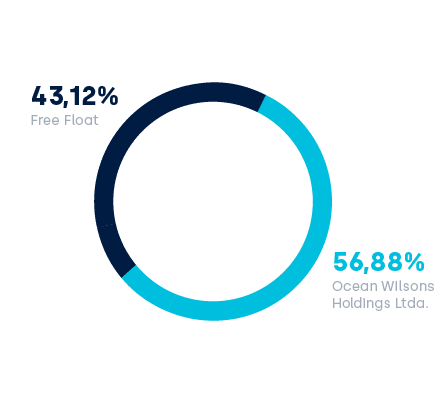

Wilson Sons is a shareholder controlled company by Ocean Wilsons Group, listed on the London Stock Exchange via Ocean Wilsons Holdings Ltd, for over one hundred years.

Source: Itau Unibanco (updated on 29th June 2021)

Our Code of Ethics and Corporate Conduct expresses the values which guide corporate governance and the relationship with all the stakeholders. The documents present the guidelines for a uniform way of action for the integrity in the management and growth of the businesses.

We have an Anti-Corruption Guide, which contains guidelines which allow us to spread the moral and ethical values amongst all business units. The manual, together with the Code of Ethics and Corporate Conduct, represent our main guidelines towards integrity. We are signatory to the United Nations Global Pact and are committed to its tenth principle which is the fight against all forms of corruption, thus developing proactive internal policies to this end.

Furthermore we have an independent whistleblower channel in which our staff and other stakeholders can inform of anti-ethical situations and conduct, further to the annual integrity training program.

Considering the preventive structures in place, we also count on the compliance department, integrated risk management, internal control and auditing management, to promote efficient and effective control as well as risk reduction.

Last but not least, The Ethical Committee is responsible for treating relative information and duly deliberating with total independence, further to accompany the ongoing occurrences and resolving the conflicts which are not laid out in the Code of Ethical Conduct and Anti-Corruption Guide. The Committee is also responsible for making sure that the Executive Board is fully aware of any and all items that may impact the Wilson Sons image.

Our Executive Board is made up of professionals with solid experience in varying fields of knowledge and which will promote the long term prosperity of our shareholders. The Board is responsible for defining the Company strategy, judging in an independent manner the risk and performance matters, and supervising the actions of the Executive Directors via the approval of relevant projects and result evaluations.

Furthermore, the Board is also responsible for the approval of the release of the quarterly and annual results, as well as the dividend announcement.

The Company bylaws foresee the formation of the Executive Board, comprehending, minimally, five members, with up to two year mandates, allowing for re-election. The Board meetings are held every quarter, and, extraordinarily, when called for by any member of the Board.

Our strategy for integrated risk management looks to maximise opportunities, reduce uncertainties and overcome possible challenges. We have an Integrated Risk Management policy duly formalised, with a structured and applicable process for all the company, in order to be able to identify, assess, respond, monitor and report the risks, supporting strategic decisions, in conformity with market best practices. The Integrated Risk Management process is aligned with the directives of the Executive Board as well as the Executive Directors, which in turn define objectives, goals and limits for the area management, as well as monitoring the policy execution and the compliance with the norms related to risk management.