ESG Governance: A Strategic Asset for Companies in the Logistics Sector

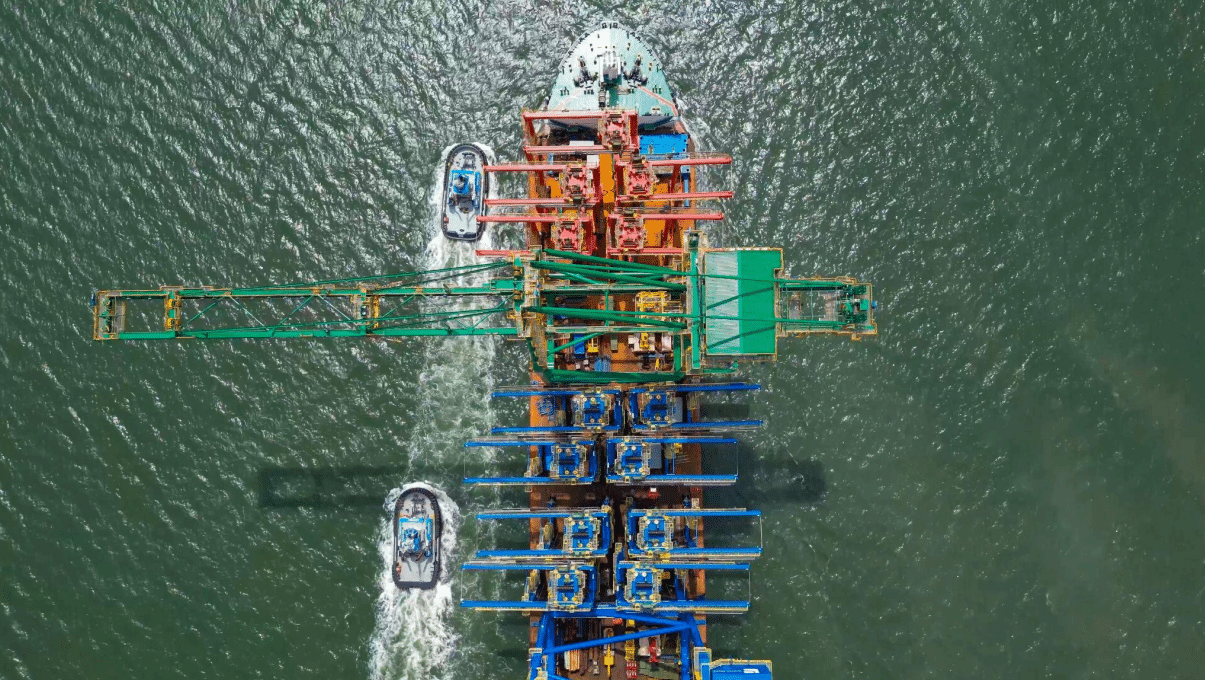

Over the past decades, the concept of corporate sustainability has evolved from a symbolic commitment into a strategic requirement. In infrastructure – and operations – intensive sectors such as logistics and ports, the adoption of environmental, social, and governance (ESG) practices has come to directly influence access to capital, international competitiveness, licensing, participation in global […]

- 25/09/2025

- 7 minutes

Over the past decades, the concept of corporate sustainability has evolved from a symbolic commitment into a strategic requirement. In infrastructure – and operations – intensive sectors such as logistics and ports, the adoption of environmental, social, and governance (ESG) practices has come to directly influence access to capital, international competitiveness, licensing, participation in global supply chains, and, above all, the legitimacy of corporate operations in the eyes of society.

Companies that structure their ESG governance in a transversal and integrated manner not only mitigate risks — they create value. By relying on data, ethical culture, transparency, and social responsibility, they operate with resilience, innovation, and a positive reputation. In Brazil, companies such as Wilson Sons have stood out by embedding ESG principles into their decision-making and operational practices, demonstrating that governance is a driver of sustainability with a direct impact on results.

This new paradigm arises at a time when the logistics sector faces growing pressures from regulators, investors, and global clients. When applied with seriousness, ESG governance allows companies to anticipate physical and reputational risks, adapt their business model to climate commitments, and promote inclusion in a structured way, thereby enhancing their capacity to generate long-term value.

What does robust ESG governance mean?

ESG governance is the backbone of corporate sustainability. It is the set of policies, structures, processes, and controls that ensure an organization’s environmental and social commitments are effectively implemented, monitored, and adjusted according to risks, opportunities, and business context. For environmental and social actions not to remain limited to institutional communication or isolated departmental efforts, governance must establish the foundations for these issues to become long-term commitments, supported by indicators, accountability, and institutionalized governance.

In the logistics sector, ESG governance must also account for the critical nature of operations, which affect not only economic results but also worker and community safety, the fluidity of international trade, and ecosystem integrity. Effective governance must therefore integrate multiple domains, from strategic planning to asset maintenance and stakeholder engagement.

In practice, this requires engaged boards and committees, clear policies, reporting systems, a culture of integrity, and processes that ensure transparency and accountability. Increasingly, investors, clients, insurers, certification bodies, and governments demand evidence of this structure to maintain business relationships or enable access to capital.

ESG governance structure in practice: The Wilson Sons case

Wilson Sons has consolidated an integrated and transparent ESG governance model. The company adopts a structured approach that includes its Board of Directors, which holds a strategic vision of sustainability, supported by a Sustainability and Risk Committee that continuously monitors the key ESG agenda topics. This committee is responsible for guiding corporate policies, reviewing material risks, validating action plans, and ensuring that issues such as diversity, energy transition, ethics, and environmental impact receive the proper institutional priority.

There is also a dedicated executive structure, with specific areas for ESG, compliance, diversity, risk, integrity, and internal audit, which ensure that guidelines established at higher levels are consistently implemented across all business units.

The company follows a Corporate Sustainability Policy that is periodically updated and guides environmental, social, and governance practices in alignment with the United Nations Sustainable Development Goals (SDGs) and the principles of the Global Compact.

The company’s materiality process, conducted with internal and external stakeholders, defines priority topics based on their strategic relevance and potential impact on business and society. These topics then guide strategic planning, tactical area plans, and individual and collective performance goals, reinforcing the transversal nature of the ESG agenda across the organization.

Integrity as a systemic practice

The foundation of governance is integrity. In the logistics sector — which interacts daily with public contracts, regulatory bodies, customs borders, and multiple stakeholders — operating with ethics and compliance is imperative.

Wilson Sons maintains a consolidated and mature integrity program, with an updated, accessible, and practiced Code of Conduct. All employees undergo regular training on topics such as anti-corruption, conflicts of interest, ethical conduct, and harassment. An independent whistleblowing channel, managed by an external company, ensures confidentiality, impartiality, and protection against retaliation.

Reported cases are handled by an Ethics and Conduct Committee with clear procedures and defined response times. In 2023, all reported cases were reviewed and, when necessary, resulted in corrective measures, reinforcing a culture of responsibility and fairness. In addition, suppliers and strategic partners undergo integrity assessments, including contractual clauses, background checks, and, in some cases, reputational due diligence.

This systemic practice creates an environment of trust, strengthens institutional relationships, and protects the company from legal and reputational risks. Recognition by external institutions, such as the Pró-Ética Seal from the CGU (Brazil’s Federal Comptroller General) and the ANEFAC Transparency Award,

reinforces the credibility of these efforts.

Reports, metrics, and data-driven trust

Transparency is the foundation of trust. Companies that wish to lead the ESG agenda must not only act correctly — they must also prove it through data, regularity, and consistency. Wilson Sons publishes its annual Sustainability Report, based on GRI guidelines, also integrating Global Compact principles, SASB (Sustainability Accounting Standards Board) metrics, and TCFD (Task Force on Climate-related Financial Disclosures) recommendations. The report is audited and publicly available, reinforcing accountability commitments.

On the environmental front, the company discloses Scope 1 and 2 emissions, as well as intensity per ton handled. In 2023, Wilson Sons reduced its absolute emissions by 4%, despite increased activity, as a result of operational efficiencies, asset electrification, and growing use of certified renewable energy. The report also details investments in energy efficiency, solar self-generation, tugboat fleet modernization, and process digitalization.

On the social dimension, the report presents data on gender, race, persons with disabilities, and LGBTQIA+ representation, both in operational roles and leadership positions. Progress in female representation, the creation of diversity committees, and inclusion programs for youth and surrounding communities are shown with indicators, targets, and results. In addition, organizational climate indices, training hours, turnover, and mental health and well-being initiatives are disclosed.

In integrity, the company reports the number of cases received via whistleblowing channels, average response time, types of sanctions applied, and preventive actions taken. All data are organized into historical series, allowing trend analysis and continuous improvement.

This evidence-based approach, supported by robust governance, transforms the report into a management tool — not just a communication instrument. Wilson Sons’ ESG governance is thus consolidated as a strategic, transversal, and reliable structure, enabling the company to operate with foresight, social responsibility, and commitment to the planet.

Experience shows that governance is not about excessive control or bureaucracy. It is about trust, coherence, and the ability to support complex decisions based on values. In an increasingly challenging sector, this governance will be, more than ever, the foundation of competitiveness.